The IRS identifies your business not by its name but by the EIN for tax purposes. To get an EIN a business needs to fulfill certain requirements. It’s free to apply for EIN.

In case you need to know the EIN assigned to your company, go through your federal tax document, business license, EIN confirmation letter, business credit report, loan application, or payroll paperwork to find it.

If you want to know another company’s EIN, you need to use the IRS database, Google, or seek help from an accountant of the company.

To find the Employee Identification Number, you can use the EIN Number Lookup tool.

How To Reverse Search An EIN:

Try the following methods to Reverse Search an EIN:

1. Google search Company Name

To know the EIN of other companies you’ll need to use some different methods, one of which is to look up EIN on Google.

Simply search by the name of the company or business on Google and you’ll be able to find all kinds of information about the company. While searching enter the word EIN along with the company name to get more accurate results.

2. IRS database

From the IRS database, you’ll be able to find the EIN of any nonprofit organization. Search for tax exemption organizations on the IRS website.

However, the IRS only provides the details of a company only in a few special cases. In case you want the EIN of a profit-based company, use the next method to get it.

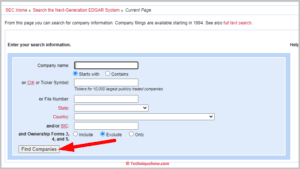

3. From Check SEC Reports

SEC reports or the Securities and Exchange Commission reports can help you find the EIN of some companies.

You need to look up the company on the EDGAR website to get its details. You’ll be asked to enter the company’s name, filing category, date range, etc while searching for the EIN.

4. Contact the company’s accountant

In case the above method couldn’t help you get the EIN of a company, you can seek help by contacting any accountant for the company.

If you have any internal networks in the company they will be able to help you get the EIN too. Approach the company formally if you have a valid reason for looking for their EIN.

5. Business credit report

By checking the business credit report of any company you’ll be able to find their EIN. There is a good chance that the company whose EIN you’re searching for already has a credit report.

You need to manage getting hold of it to check the EIN from it. It can be done by searching for the credit report online or by taking the help of any officials from the company.

How To Find Your Employer Identification Number:

These are the following methods that you can try:

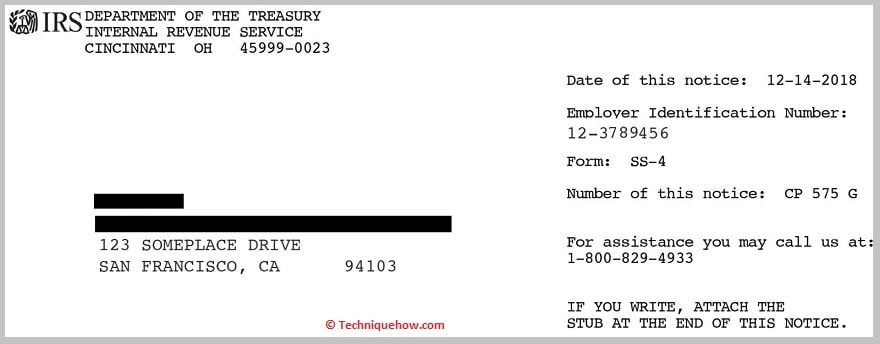

1. EIN Confirmation Letter

Finding your EIN isn’t a big deal but you’ll need to go through a few papers and documents. There is a good chance that you’ll find your EIN in your EIN confirmation letter issued by the IRS.

How to find EIN in a confirmation letter:

🔴 Steps To Follow:

Step 1: On the right side of your confirmation letter, you’ll find the Employer’s Identification Number.

Step 2: In case you’ve applied for EIN online when you may have saved the receipt which you can check to get the EIN.

Step 3: If you’ve applied for an EIN by mail, then you’ll be able to get your EIN from the email you’ve received from the IRS.

Step 4: In case it’s applied through fax, check the fax sent by the IRS to get the EIN.

2. Business licenses and permits

Your EIN can also be found on your business license and permit. While filling out the Basic License Application you are required to enter your EIN.

Therefore the business license granted to you after your business was approved by the state, has your EIN on it. It’s a 9-digit numeric code.

3. Business bank account

Your EIN can be found in your business bank account’s information. The bank account that belongs to your company or business is linked with your EIN. Therefore if you download your business bank account statement, you’ll be able to get your EIN or tax ID easily.

It’s mostly located on the right side of the account statement, along with the other details of your account.

4. Tax notices from the IRS

If you have an official tax notice sent to you by the IRS, use it for finding your EIN. The IRS often sends official notices when it charges a fine or penalty. On the top right side of your formal notice, you will find your EIN.

These are important documents which is why you should never lose them.

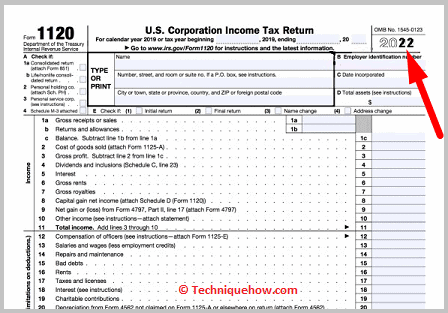

5. Federal tax returns

When you get a tax return from the IRS, you receive a document from them. On the copy of your tax return document, you’ll find your EIN or tax ID along with other details. Thus if you have any prior federal tax return documents, bring them up to see your EIN.

If you don’t have a copy of your tax return, then you can apply for it to the IRS. It can be done for free by using the 4506 form.

6. Loan applications

Have you applied for business loans previously? On the loan application, you’re required to enter your EIN to get a loan for your business. In case you have the loan application or a photocopy of the document, take it out for checking your EIN quickly.

🔴 How to find:

Point 1: Even if you’ve applied for your loan online, you can log in to your online loan portal to find the EIN.

Point 2: You might be able to get your EIN if you have kept a screenshot of your online loan application.

7. Business credit report

On your business credit report, you will also find your EIN. It’s a document that measures your business’s monetary stability.

On your business credit report, you’ll have all kinds of information and details about your business such as your company profile, EFX ID, location, ownership type, etc. The tax ID which is provided right below the telephone number is your EIN.

8. Calling the IRS

Call the IRS to know your EIN. The IRS won’t share the EIN of any other business with you except for your own. You need to call the IRS on their IRSs Business and Specialty Tax Line to know the tax ID.

They might ask you a few questions and the executive or the agent on the call will provide you with the tax ID or EIN. However, you can’t just call them at any hour but it’s only available from 7 am to 7 pm during the weekdays i.e Monday to Friday.

9. Payroll paperwork

If you’re an independent contractor, then you might have your payroll paperwork. It’s a form where you’re asked to provide different business-related information to the state tax department.

On the form, you are also asked to enter your EIN under RECIPIENT’S TIN. You can check it to get your EIN.

Frequently Asked Questions:

1. Is the business tax ID number the same as an EIN?

Yes, EIN is the same as the tax ID of a company. It’s a combination of some digits that’s unique for each company. It’s used for identifying a business for filing taxes or any other tax-related purposes

2. Can you have a business without an EIN?

You can have a business without an EIN when you’re a sole proprietor and don’t have other workers working for your business. But if you need to hire employees to work for your company, you need to register your business and get an EIN.